What Would You Do for a Klondike Bar?

In 1982, Unilever came up with a catchy jingle to sell Klondike bars, a sort of Eskimo pie without a stick: “What would you do for a Klondike Bar?” The challenges weren’t especially grueling. Would you make monkey sounds? Act like a chicken? In one spot, a boneheaded dudebro actually listened to his wife talk […]

We Now Interrupt This Broadcast…

On Sunday, October 30, 1938, Mercury Radio Theatre fans, who were listening to Ramon Racquello and His Orchestra, were interrupted by a news broadcast reporting an odd explosion on the planet Mars. Soon after, they learned that a cylindrical object had fallen on a farm in Grovers Mills, New Jersey. The radio audience listened in […]

The Twelve Days of Taxmas

Every year, PNC Bank publishes their “Christmas Price Index” to track the cost of the Twelve Days of Christmas. For 2017, it’s a hefty $157,558. (And you thought your holiday spending was out of control!) The index may not be completely accurate — for example, the ten lords-a-leaping are valued using the cost of male […]

A Different Kind of Holiday Party

Your kids have finally finished eating their Halloween candy, which means that the real holidays are right around the corner. But before you sit down to open presents, December 16th marks the 244th anniversary of an important holiday in tax history — a pop-up costume ball in Boston Harbor called the Boston Tea Party. From […]

Area Actress to Wed Ex-Soldier

Two hundred and forty one years ago, we declared our independence from Mother England — over taxes, of course. But here on our side of the pond, we’ve never completely lost our affection for all things British. We applauded as the Queen celebrated her 70th wedding anniversary. Netflix fans who just finished binge-watching Stranger Things […]

Good Guys Share $175 Million Refund

April 15 hasn’t always been the national exercise in self-flagellation that it is today. Up until the 1940s, you could just waltz into your local IRS office and they would do your taxes for you. But those days have long since passed. You’re still welcome to do it yourself, if you need more stress in […]

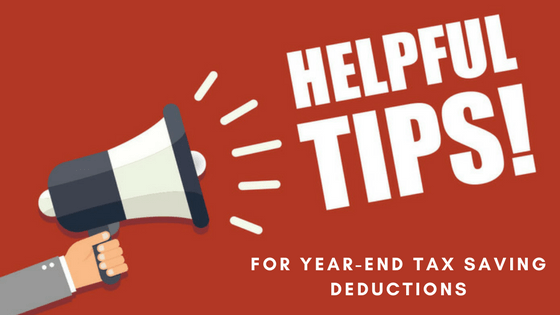

Top Tips for Year-End Tax Saving Deductions

Every business wants to make money, but nobody likes writing large checks to the IRS. However, if you’re expecting a significant income before year end, you may want to consider creating more year-end tax saving deductions. Here are some strategies you can use: 1. Prepay for recurring expenses. Cash basis taxpayers can prepay and deduct […]

Reimbursements and Using An Expense Report

Small business owners tend to make the mistake of commingling their monies. Business and personal purchases are on the same credit card. Without a system in place, those blurred lines make the IRS question everything about your tax reporting. Tax rules do not require a business to have an accounting plan. However, it is in your […]

Is your office a tax-reporting wreck?

Have you ever had the feeling that you don’t want to step into your office because it’s a total mess? Perhaps you have so many piles of paperwork that if anyone else were to look for something, they wouldn’t know where to start. You’re not alone. All business owners know that end-of-year is a dreaded […]

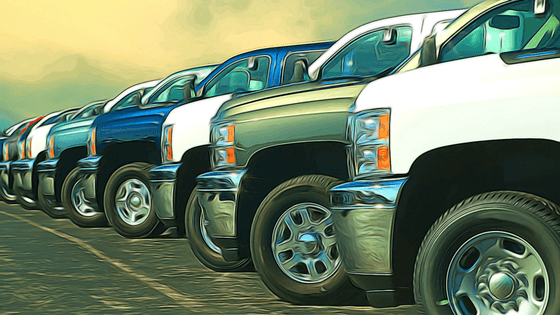

Will a last-minute vehicle purchase save you on taxes?

Your business has seen success this year – Yeah! That’s awesome. In fact, you may be considering buying a business vehicle as you make expansion plans for next year. Or, you only need an additional tax deduction for this year. To get the tax deduction, you’ll need to a) own the new vehicle & b) […]