Have a Coke and a Tax

When most of us hear the word “tax,” we immediately think “IRS.” It’s natural to associate those three-letter words with each other (even if “IRS” is an acronym and not a word). But our friends at the IRS are hardly the only tax collectors with their hands out for your money. State and local governments […]

Barry Good!

Humorist Dave Barry entertained millions of readers with his nationally syndicated column from 1983 to 2004. Along the way, he earned a Pulitzer Prize for commentary, inspired a television series (Dave’s World), and even, after mocking the cities of Grand Forks, South Dakota and East Grand Forks, Minnesota, earned the honor of having a sewage […]

Mickelson Lands in the Rough

Spring is here, and golfers across the country are busting out their loudest pants to hit the links. Tiger Woods is taking a break from chasing pancake-house waitresses to shank wedges into water hazards. And Phil Mickelson, everyone’s favorite lefty champ, is struggling with a different sort of hazard right now . . . specifically, […]

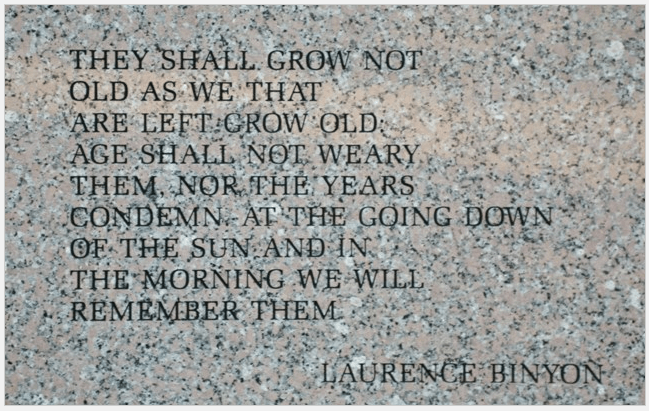

Get Tax Credit for Hiring Veterans

As we reflect on Memorial Day, we remember that our freedom did not come without cost. Our military service personnel are putting their lives at risk so that we can enjoy the American dream everyday. For that, we at Paragon Accounting and Tax Solutions are truly grateful. As our military veterans return home, getting back […]

Combining Business and Pleasure on Business Trips

If you’re a small business owner, there are legitimate ways of combining business and pleasure on a business trip. Of course, not all of it is going to be tax-free. However, simple pre-planning before going to a conference, education seminar, trade show or networking event allows you some flexibility of combining business and pleasure. Perhaps […]

Tips To Gain More In Business Travel Write Off

A recent AAA survey predicts the average amount spent by a family of four for vacation this year will be $692, down 14 percent from last year’s $809. Here are some tips for your business travel write off planning: Business Travel Write Off Starts By Getting There: If the trip is primarily for business and […]

A Tale of Two CEOs

Every year, business reporters look forward to listing the country’s highest-paid CEOs. Corporate chiefs have always done well for themselves — in 1980, the average S&P 500 head earned 42 times more than the average worker. But lately those compensation numbers have swollen fat enough to boggle Stephen Hawking’s mind — in 2000, the CEO-to-worker […]

How To Benefit A Deduction From Sports Tickets

Are You Getting The Most Deduction From Your Sports Tickets? Bruce is a business owner. He has 2 season sports tickets to watch the Atlanta Falcons in action. He is going to be out of town for the Cowboys game. So, he decides to give his 2 sports tickets to his top client who recently […]

How To Better Plan for A Business Entertainment Expense

When To Deduct 50% or 100% for Business Entertainment Expense? Celebrating With Food, Employees and Clients Last month, we celebrated the end of tax season by throwing a client appreciation party. Paragon, as the host, purchases all the food and drink for this event. As a business owner, should this count as a 50% or […]

The Gambler, The Billionaire, and The Game of Kings

Backgammon is an ancient game of dice, strategy, and skill. The name dates back to the 1600s, but the game itself goes back to the Byzantine Emperor Zeno (AD 476-481). While it’s never been as popular here as poker or chess, it became a huge fad in the 1960s, with Playboy founder Hugh Hefner hosting […]